If the automotive industry had a constant trait, that would be continuous evolution and technological breakthroughs. Although constant innovation in this field keeps pushing the boundaries in product design and utility, auto companies still struggle in managing working capital. One can blame such a problem on many factors, mainly rising DIO* and DSO* levels how quickly inventory is turned into a sale, and how quickly a sale is collected, respectively. This issue cannot be addressed simply by adding horsepower or stacking up “car of the year” awards. In addition, the automotive sector is a vast network of suppliers, manufacturers, and dealerships exchanging goods and services across various channels. This forms an often interconnected supply chain relying heavily on movement of money and dependent on the efficiency of said transactions. Thus, companies need to address ways of having a financial backbone that is fit to better manage and optimize working capital.

As the industry continues to evolve due to disruptive technologies, continuous regulations on emissions and pollution, and the recent repercussions of the Covid-19 pandemic, the benefits of having a nimble and agile financial structure have never been more pronounced. Troc Circle works on streamlining financial exchanges, and helps optimize the company’s working capital by freeing up cash from inefficient cash chains.

Targeted repairs

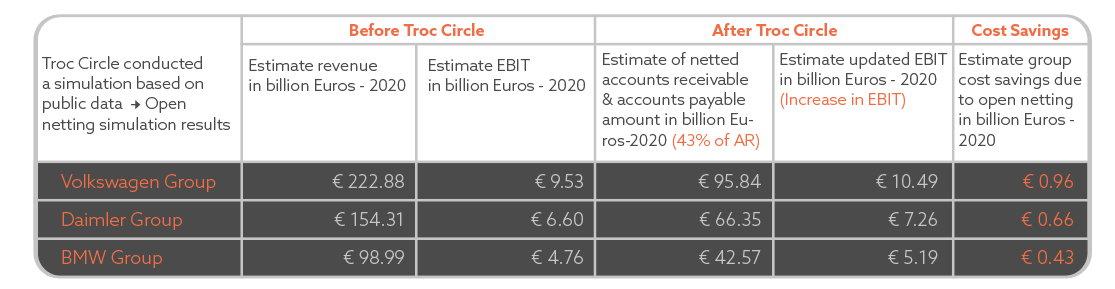

Being specialists at targeting and netting cash flow inefficiencies, Troc Circle has the ability to unlock capital which is stuck between members of the automotive supply chain. Focusing on the German automotive industry and using publicly available data, netted amounts in billions of Euros were found to be possible, and great opportunities for the auto industry loomed in the horizon with 43% of the industry receivables being open to netting.

Generating helpful insight

Recent studies showed that 24% of finance time is spent on insight-generating activities, a practice which Troc Circle could be crucial in enhancing. As inefficient exchanges are netted out, companies free up both time and capital.

- Facilitated tracking of cash flow activities with measurable results.

- Proactive system of payables and receivables

- Improved DSO and DIO performance

- Companies can invest more in data generating activities crucial for future design and predicting maintenance trends

- Manufacturers are able to maintain a grasp on demand for automobiles and spare parts

Hundreds of terabytes of data are gathered by car companies on a daily basis, and processing this data requires huge sums of capital. Every cent invested in data analytics adds to the competitive edge of an auto-maker, and Troc Circle proves to be a major tool in optimizing working capital.

Agile financial performance

A new rhythm is being dictated by lightspeed advances in design and powertrain, as well as by emerging business models and innovative value chains. Automotive companies need to revamp or transform outdated financial structures and practices in order to accommodate for the changes that are fastly occurring. A proactive financial system with agile and responsive tools -- like Troc Circle helping streamline inefficient practices -- should help automakers keep up while keeping track of all financial activities. Due to its boosting effect reaching several departments of the business, Troc Circle is the solution that adds value to the automotive industry and gives companies a competitive edge and great chances for growth.

Disclaimer:

The mentioned simulations were performed using publically obtained data from the PwC working capital report 2019/20, the PwC Working Capital Trends in the Automotive Sector 2017 report and the annual financial statements of BMW, Volkswagen and Daimler.