In today’s ever-changing insurance market, customer experience has become a crucial differentiator among carriers. Catering to customer needs is increasingly relying on a flawless value chain that includes B2B enhancements as well to back up to the B2C experience. On the other hand, the recent surge in automation and digitalization in company processes is reaching the insurance sector and has been further underscored due to Covid-19. The pandemic pushed the shift of insurance customers to seek digital services and avoid human interaction altogether. Insurance companies have been among the late adopters of tech especially in their financial departments, but the trend could be picking up.

Back-and-forth

The insurance industry struggles with being heavily reliant on human interaction since a high number of working hours is spent on lengthy basic tasks like claim processing. Claims processing may take up to 3 months or more and then be concluded with insurers exchanging payments. Let’s consider, for instance, a road accident taking place in Germany, and two or more insurance companies will now be processing claims filed by the involved parties. The German insurance market has a few top players like Allianz, Generali, and AXA, and in case of a property and casualty claim; there’s a chance that one or more of these companies would be involved in the claim process with other carriers. The inevitable exchange of cash that ensues from claims could be one of these companies’ tools for success or failure in the insurance market, so finding the right balance and efficient practice for managing these cash flows is crucial. In addition, these companies are leaders in their markets and often operate at high levels of efficiency and standards, so they could represent benchmarks of performance in the market.

The Missing Financial Link

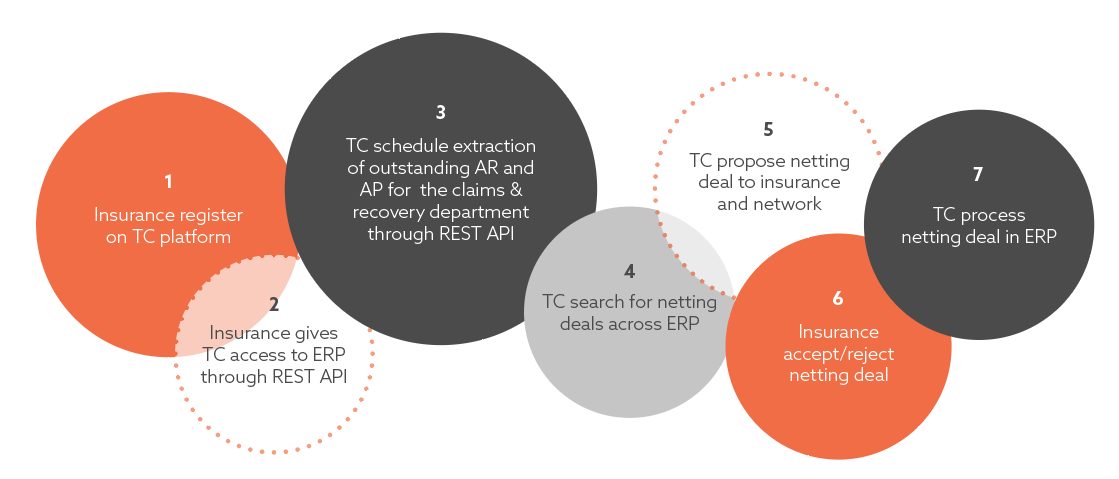

In lieu of such exchanges having to take place in numerous cases, Troc Circle is quick to realize the streamlining and remedial effect that its netting platform can have on insurances’ receivables and payables. Given the interrelated nature of claims processing and the fact that often two or more companies are involved,Troc Circle acts as a link between insurers and paves a quick route for payments to be managed back and forth between them. The market leaders mentioned previously can also be catalysts for helping apply such disruptive financial practices that greatly benefit them and the market as a whole.

Whenever a netting deal is found, a lot of time is saved in claim processing — more than 40% per claim. Netting speeds up the payment process as unnecessary exchanges are eliminated; leading to lowered management cost of accounts payable and receivable. Insurers that register on Troc Circle can directly start to benefit from netting.

Troc Circle’s algorithm works by detecting connections between invoices on the platform and proposing netting deals for insurers to approve. The customizable nature of Troc Circle allows insurers to select when, where, and with who to do netting deals. Customer needs and policy types can play a role in specifying the parameters that insurers may work with while netting. Simplicity and adaptability are a cornerstone of Troc Circle’s approach. With a click, netting is done and time is saved.

The Way Forward

Numerous companies are resorting to practices like hyperautomation*, and digitalization in order to be ready to serve their customers as promised and survive in the market. Fabrizio Biscotti, research vice president at research and consulting company, Gartner, says; “Organizations will require more IT and business process automation as they are forced to accelerate digital transformation plans in a post-COVID-19, digital-first world.” Troc Circle offers a safe, and smart alternative to investing in bridge financing and other costly financial technologies.

The redefinition of business models and value chains must consider the customers’ perspective and optimize back-end processes in order to support and speed up the servicing of claims. Being able to serve customers in any way possible is achieved only when a company creates the nimble and automated system it needs to be proactive in handling any claim. Companies netting payments among each other would not only save them time and capital, but would also greatly reduce strain on their financials and further raise the standards of their overall operations.

As many insurance companies have already begun automating high-volume tasks while keeping human expertise for high value decisions, Troc Circle looks to replace the missing link in streamlining company finances and driving efficiency across all facets of the business. Swift and secure payment processing forms one of the pillars of an efficient and successful insurance business.