Upgrade to a merchant account in order to receive payments. To this date, Troc Circle supports only US, EEU & UK-based merchants. More to come.

Our payment services

Merchants must first be vetted before they can be onboarded – allowed to begin accepting payments. Troc Circle is responsible for screening sub-merchant applicants to avoid allowing bad actors into the system, a process known as underwriting.

Underwriting involves following Know Your Customer (KYC) requirements to verify that the businesses are who they say they are. It also involves checking them against lists of entities with connections to crime and terrorism.

As payment facilitator we take advantage of technology to streamline this process, making a seller’s path to accepting payments much faster. Software is available to help automate database checks and flag suspicious findings for further examination by a human. This is known as frictionless underwriting.

Once sub-merchants are onboarded and accepting payments, Troc Circle is keen to provide any needed customer service.

After a submerchant is onboarded, Troc Circle remains responsible for making sure payments are legitimate and adhere to card network and government rules and regulations. So, as the payment facilitator, we monitor the transactions that pass through the system for suspicious activity. Similar to underwriting, we leverage Finix's technology to watch for anomalies and flag them for risk management personnel.

Troc Circle takes on the responsibility of funding – paying out the money sub-merchants are owed. While doing so means taking on more liability for fraud and risk mitigation, it is worth that, because it helps our users manage the experience they are providing for their customers. Because we collaborate with Finix, a lead payment facilitator, we provide quick access to funds for sub-merchants, a significant benefit, particularly for smaller businesses.

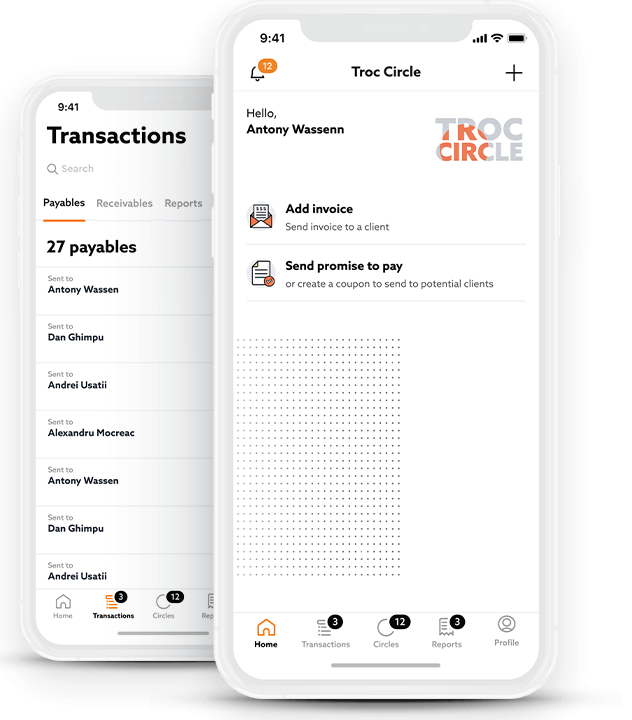

To this date, Troc Circle supports sub-merchants to collect their accounts receivable through Card payment and ACH payment.

Chargebacks occur when customers dispute charges on their accounts and receive their money back from their issuing banks. The issuing bank will then pass the dispute through the card network to the acquiring bank, which manages the process of recovering the funds from the merchant.

Troc Circle manages the chargeback process along with the acquirer and handles documentation requests that might arise from an investigation into whether the transaction was legitimate, and it’s liable for the amount of the transaction if for some reason it is unable to recover it from the merchant.

Troc Circle offers everything you need to grow your company, from open invoice netting to seamless digital pay-outs

LED BY TECH-FORWARD CFO's